February 3, 2026

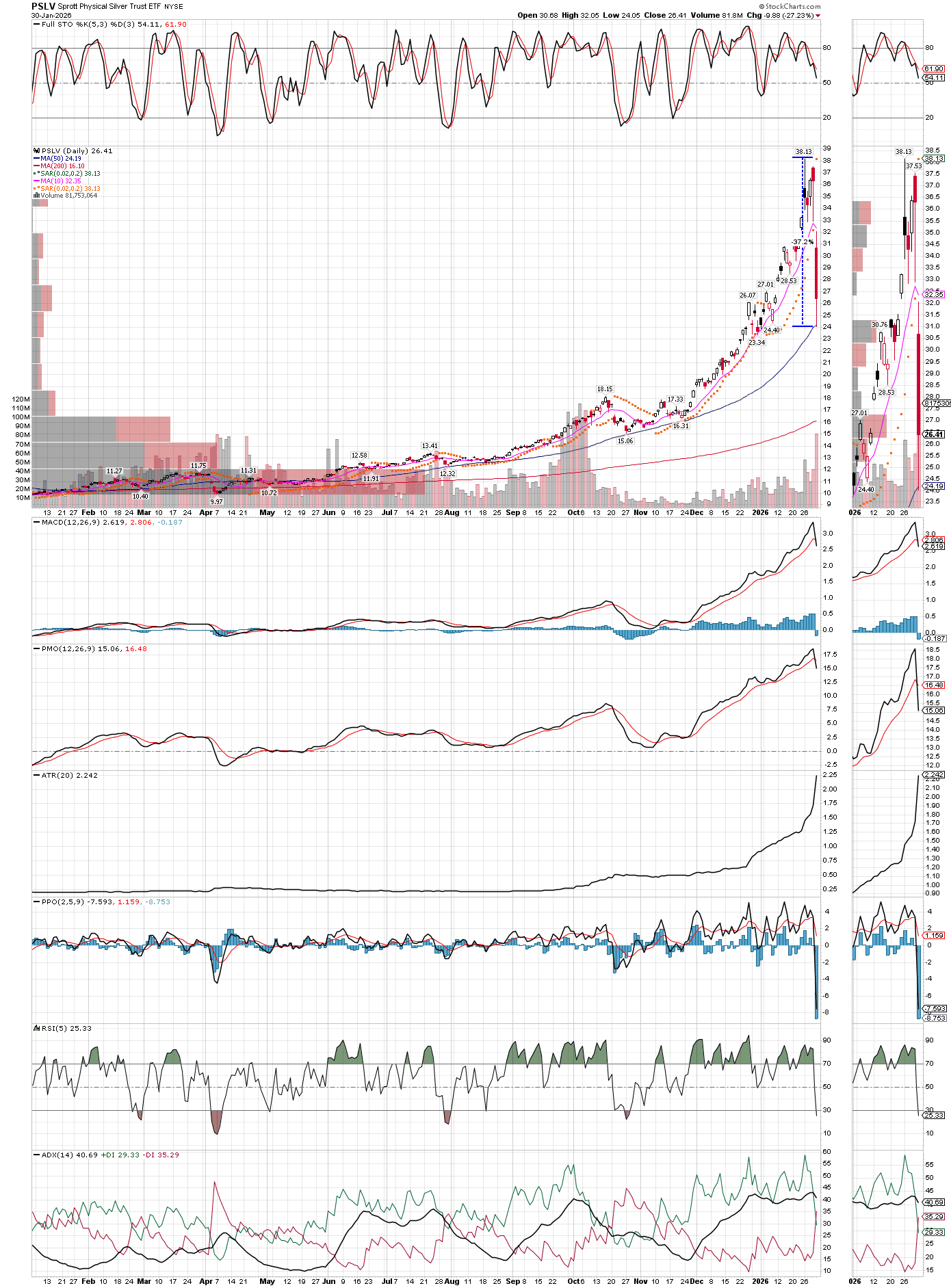

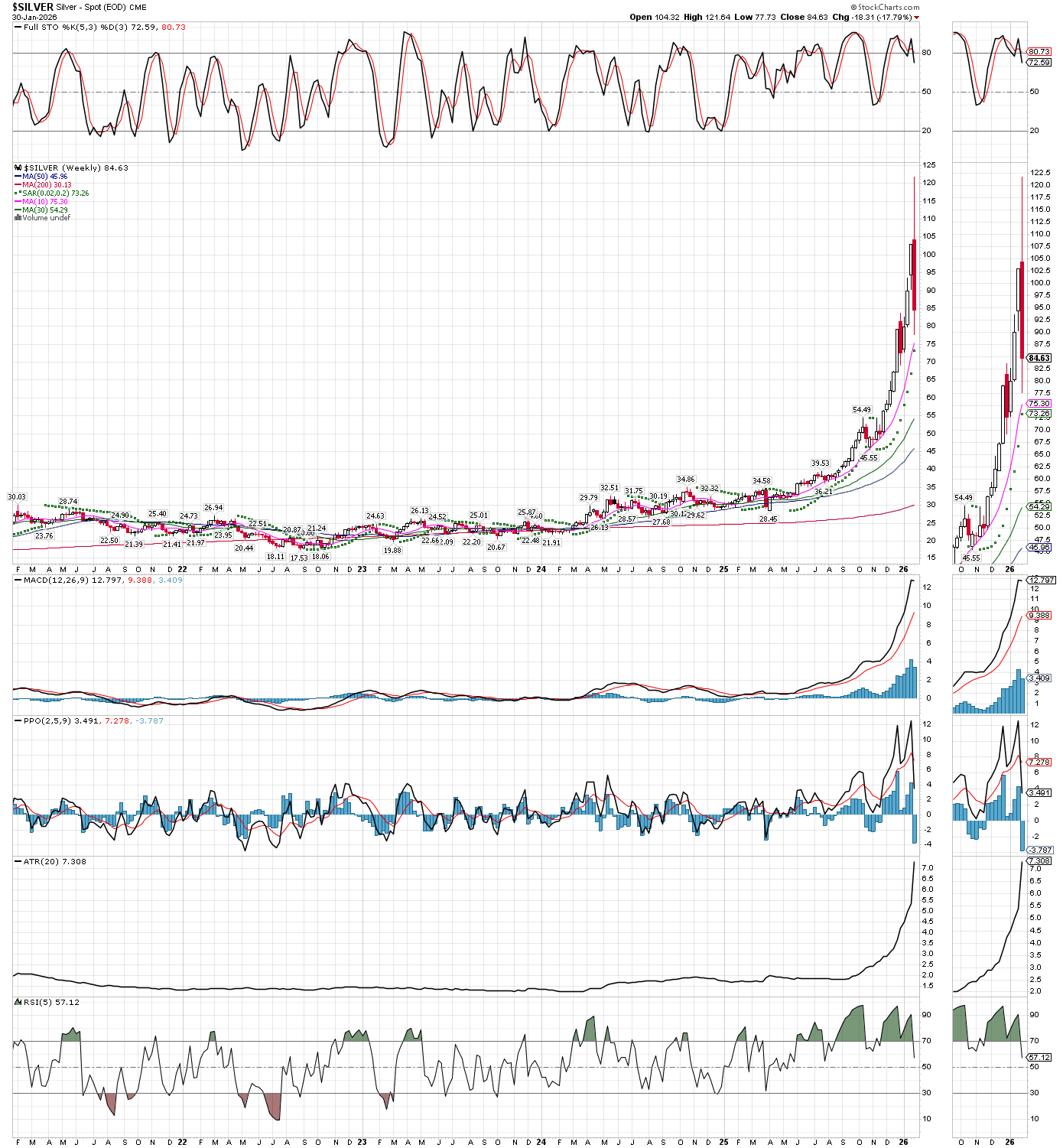

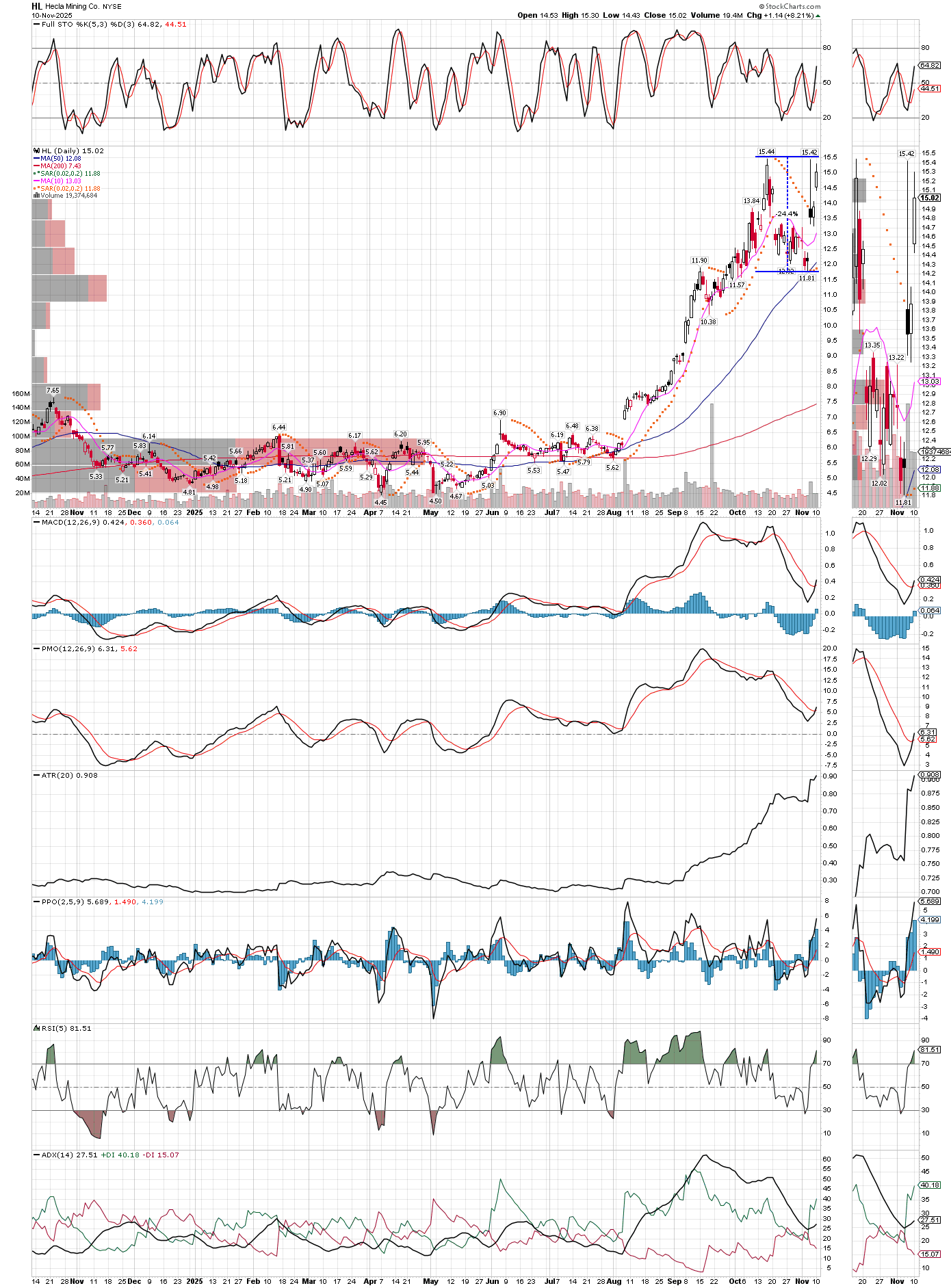

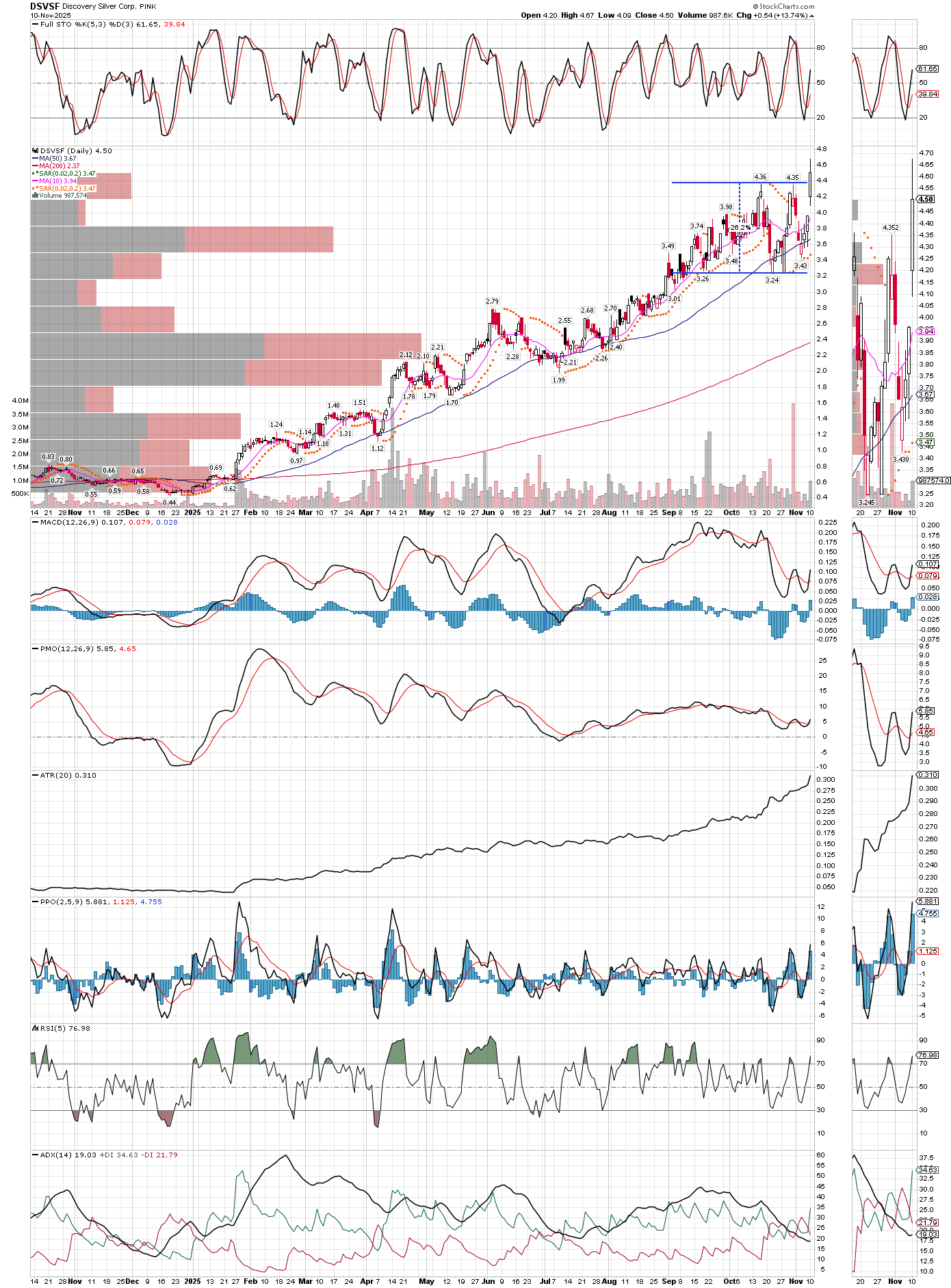

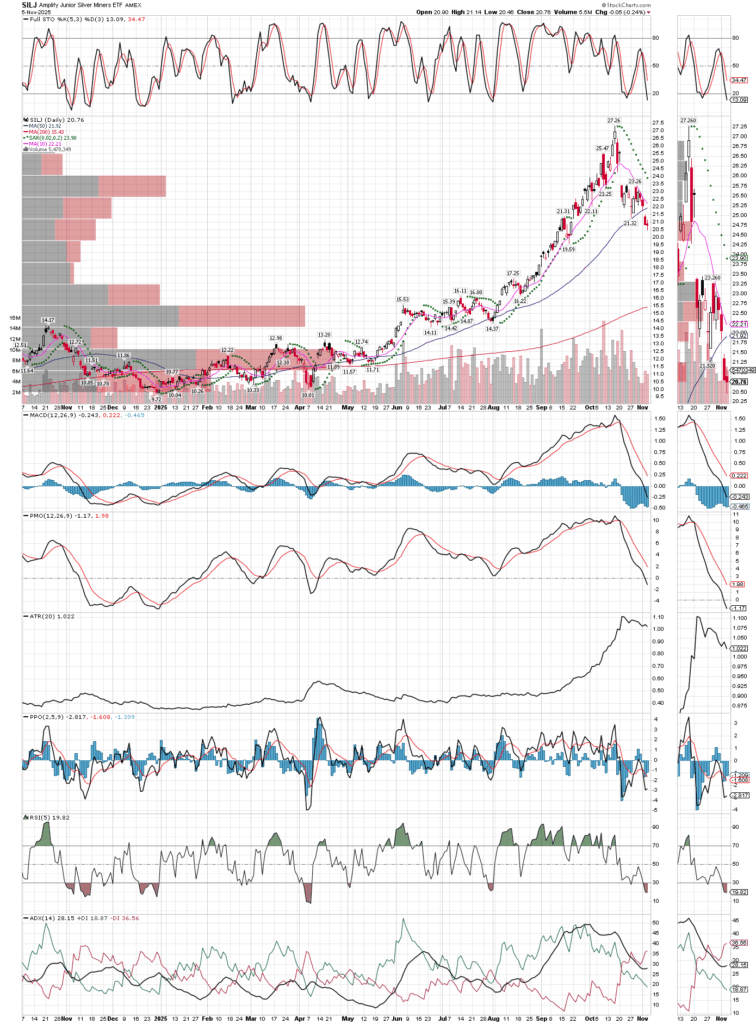

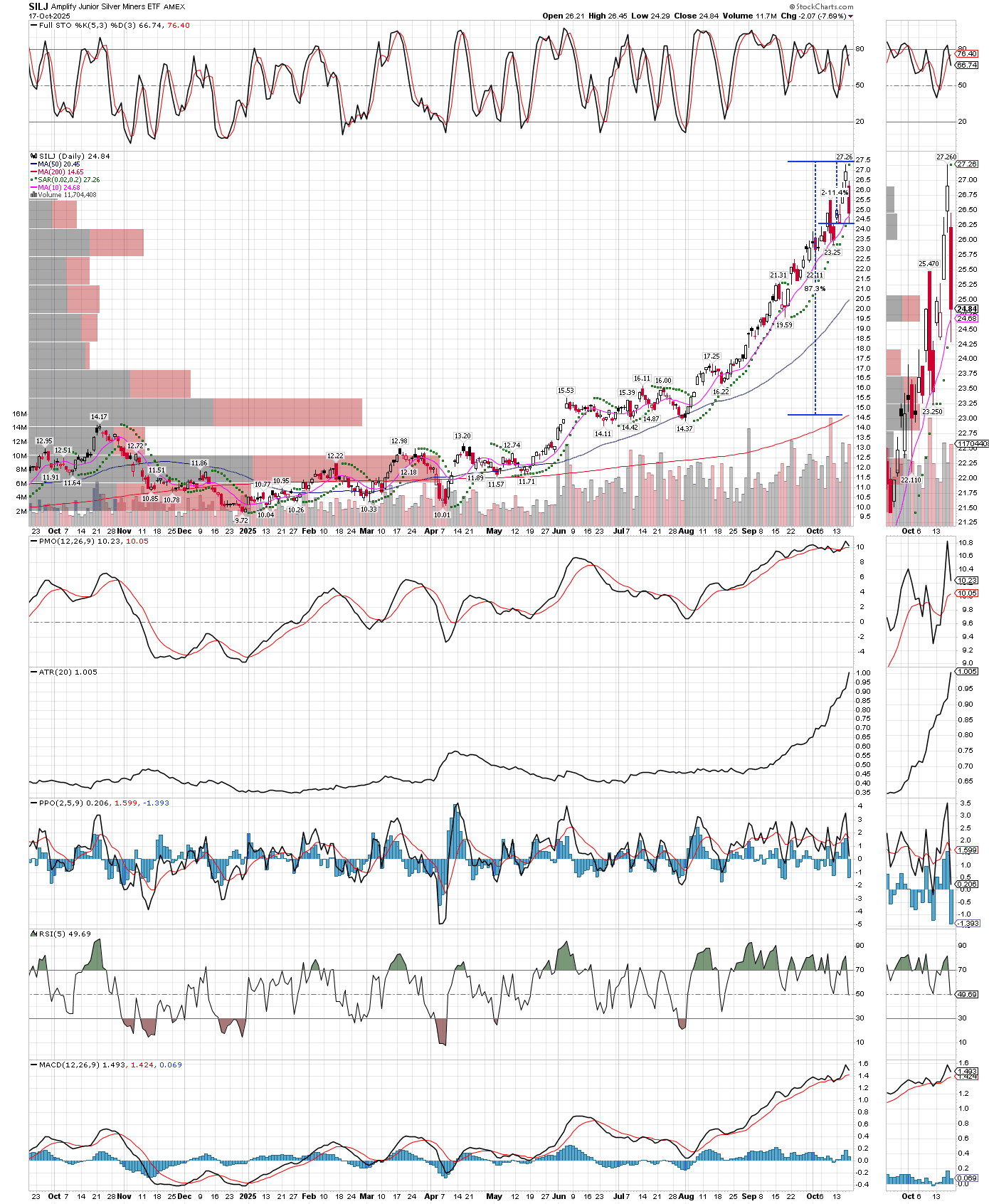

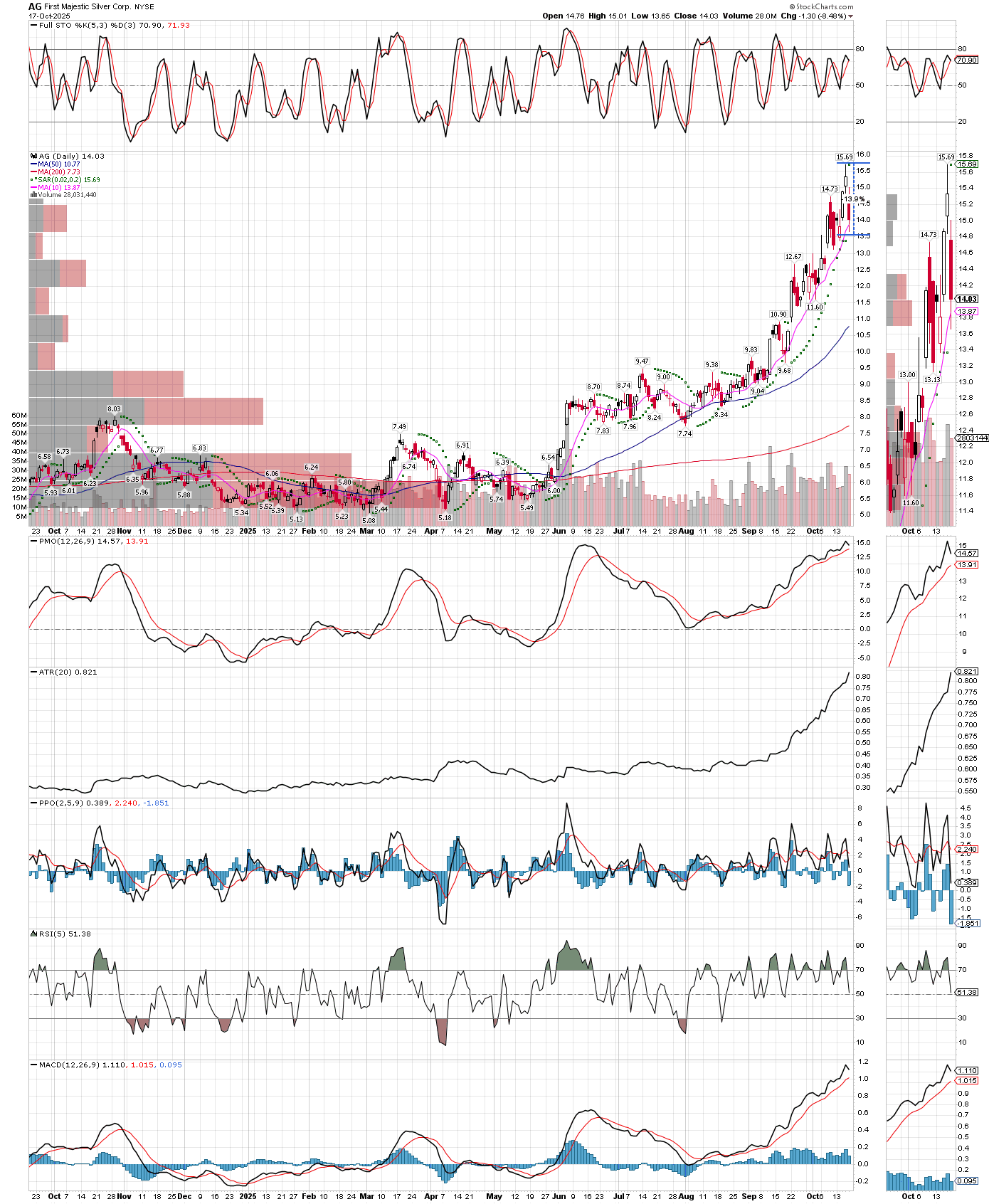

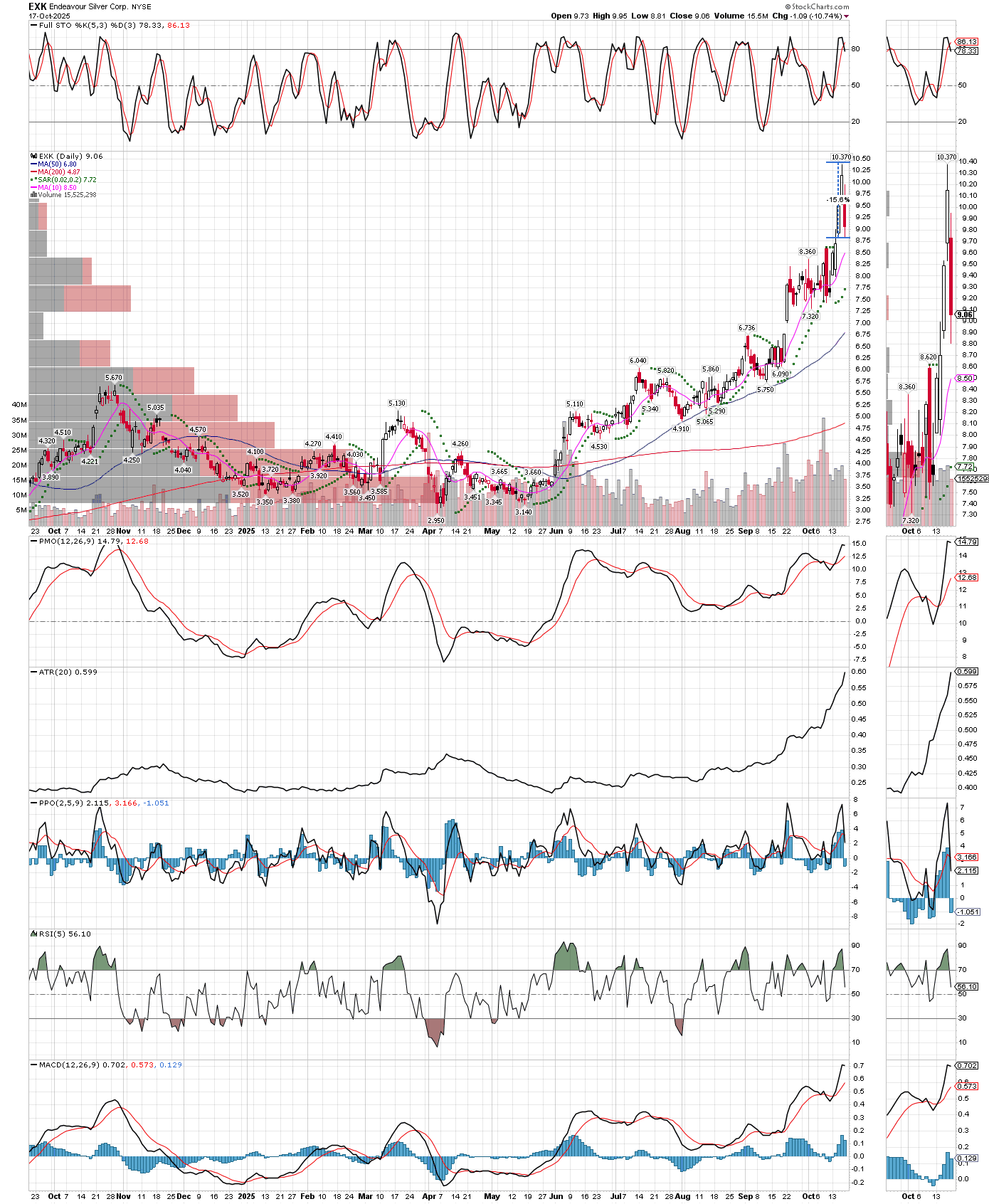

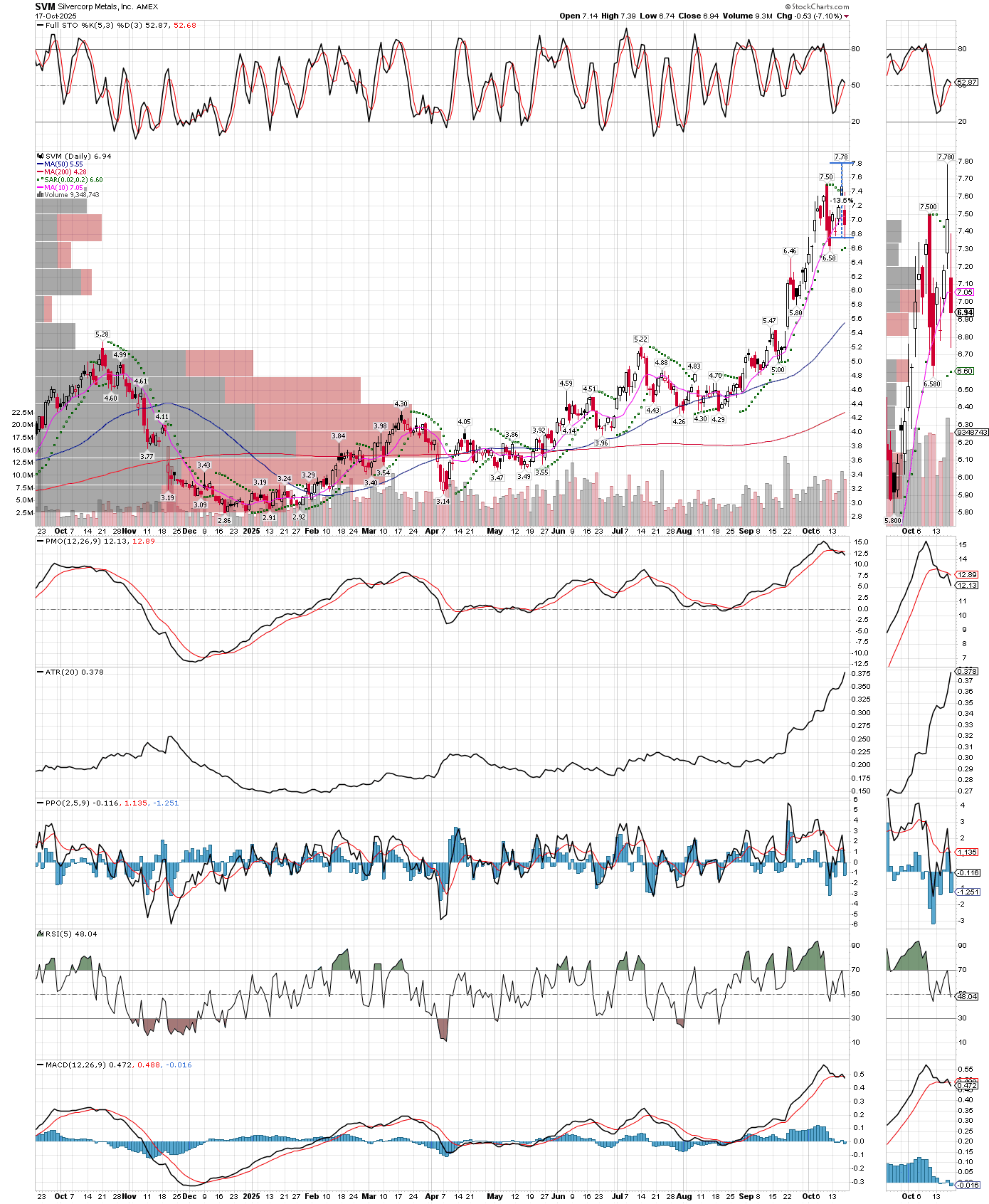

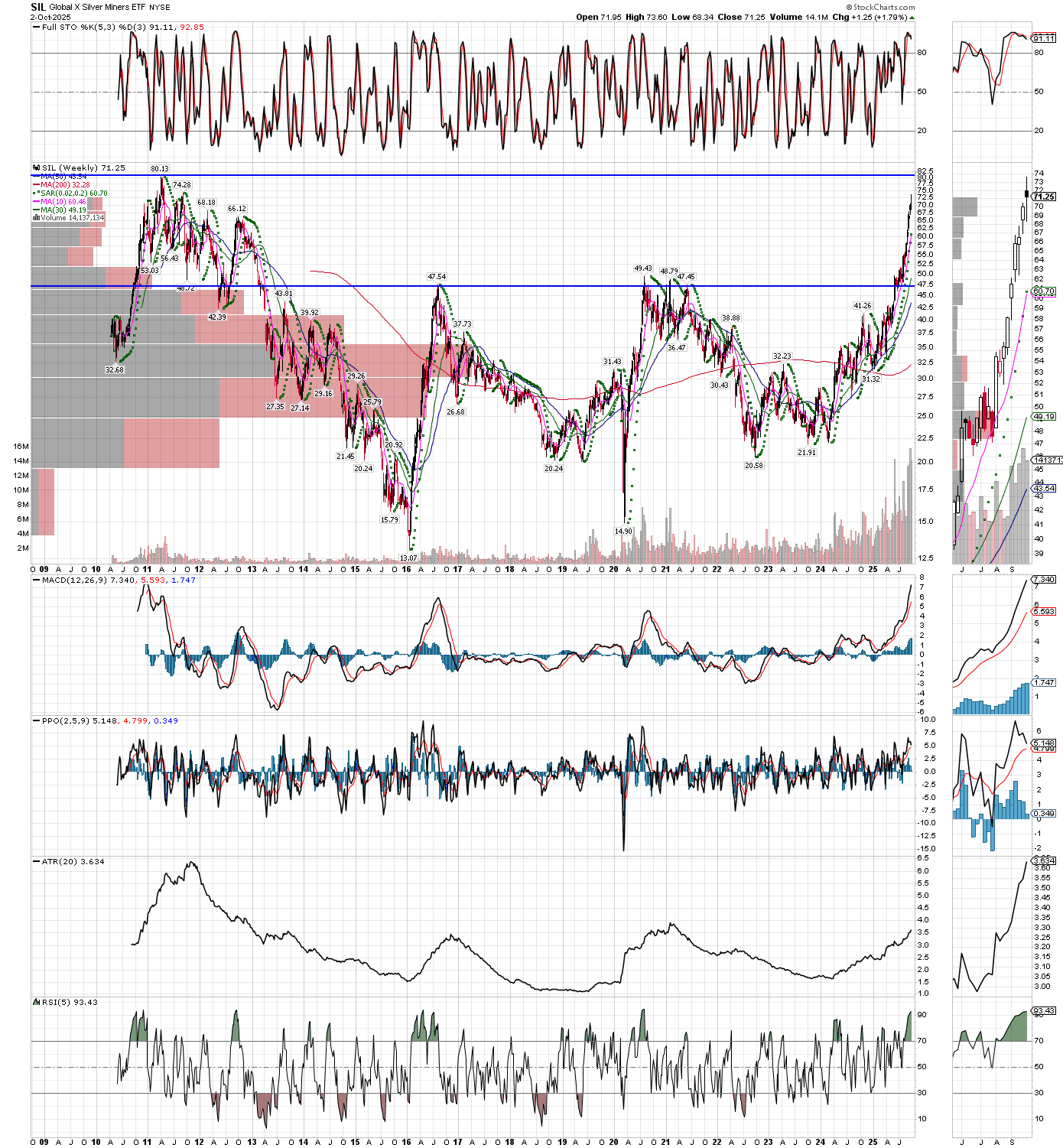

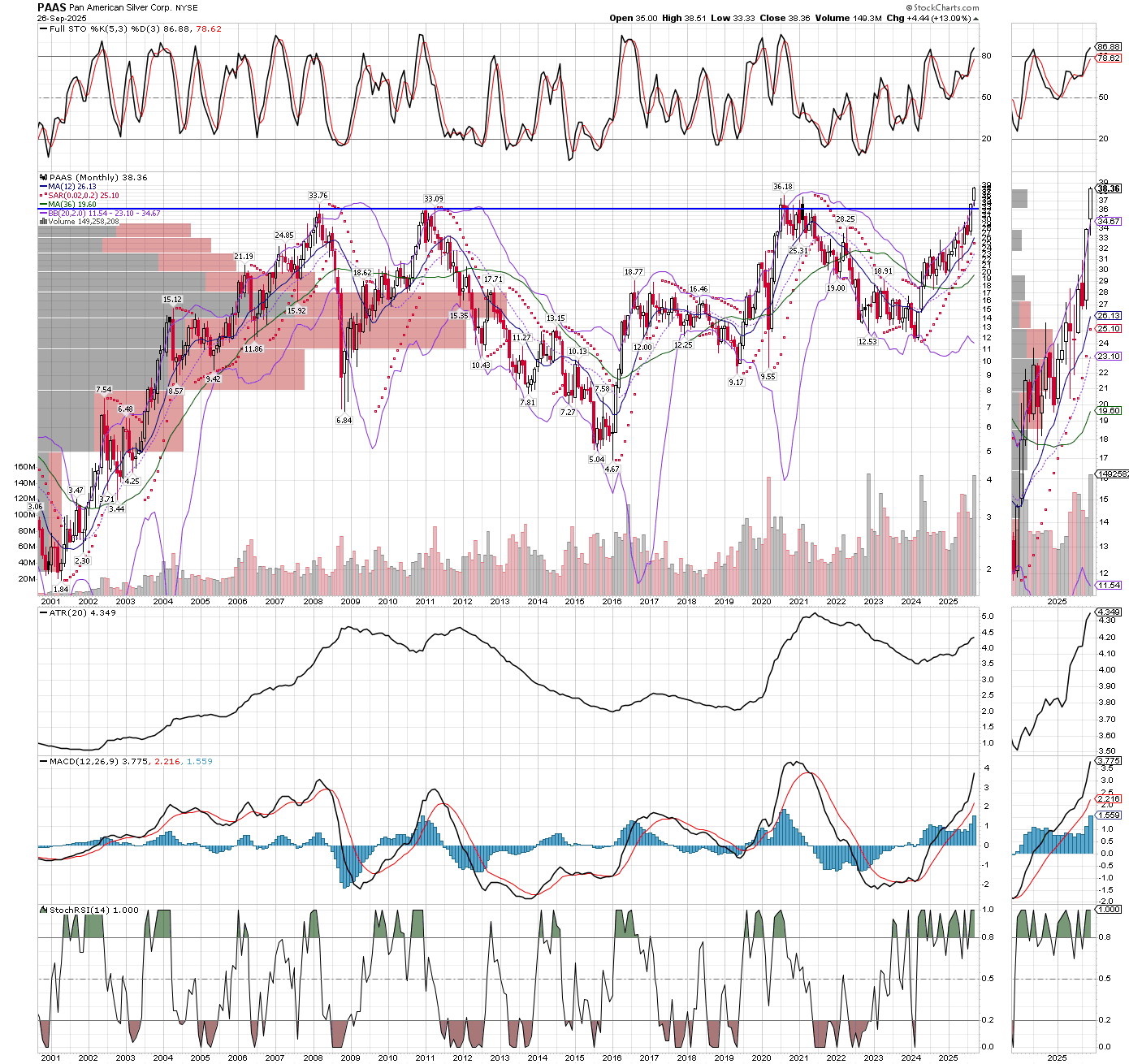

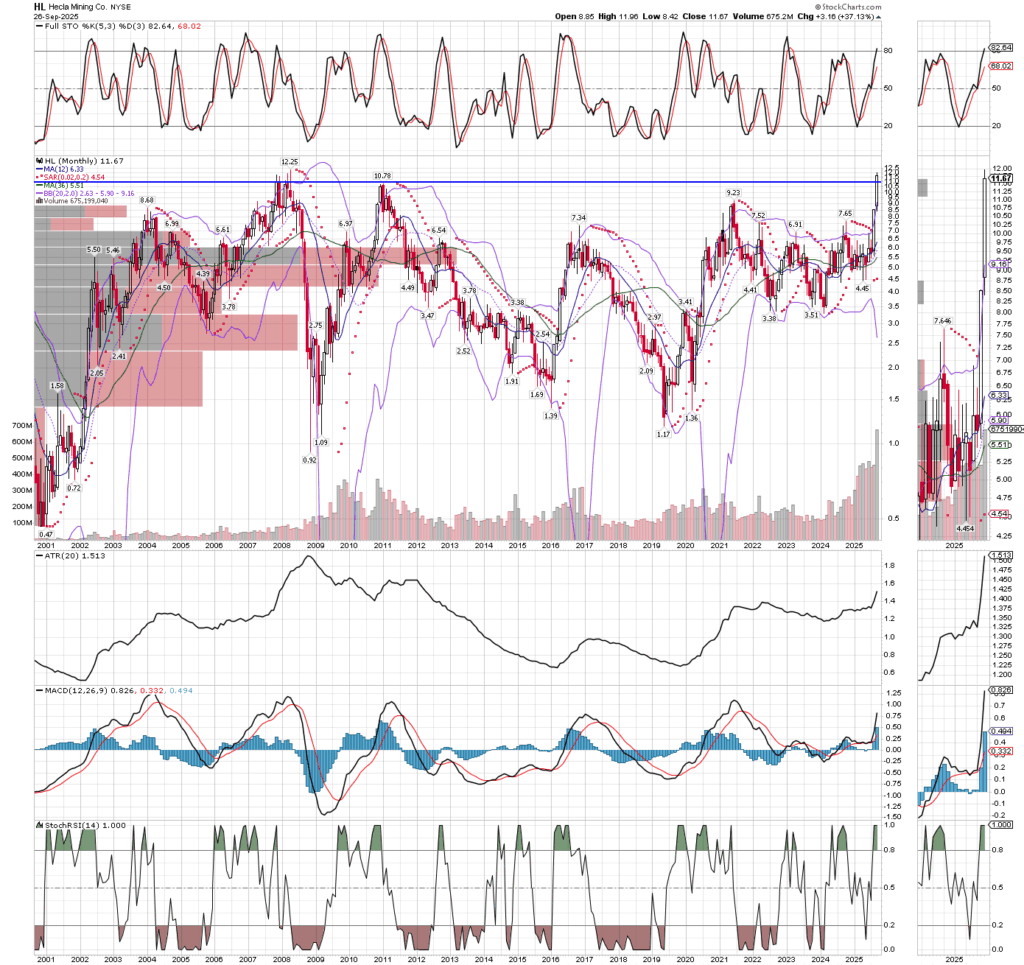

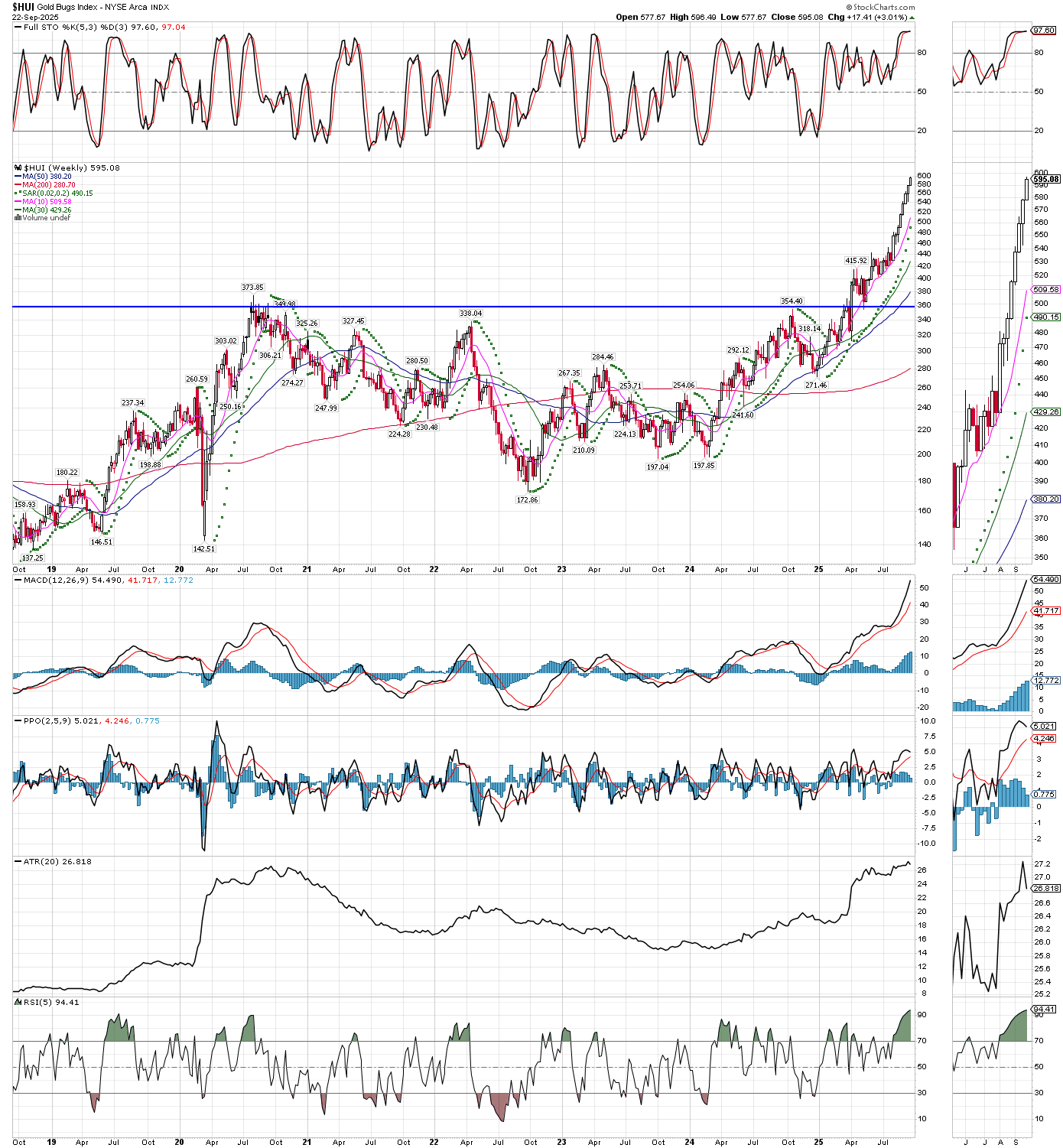

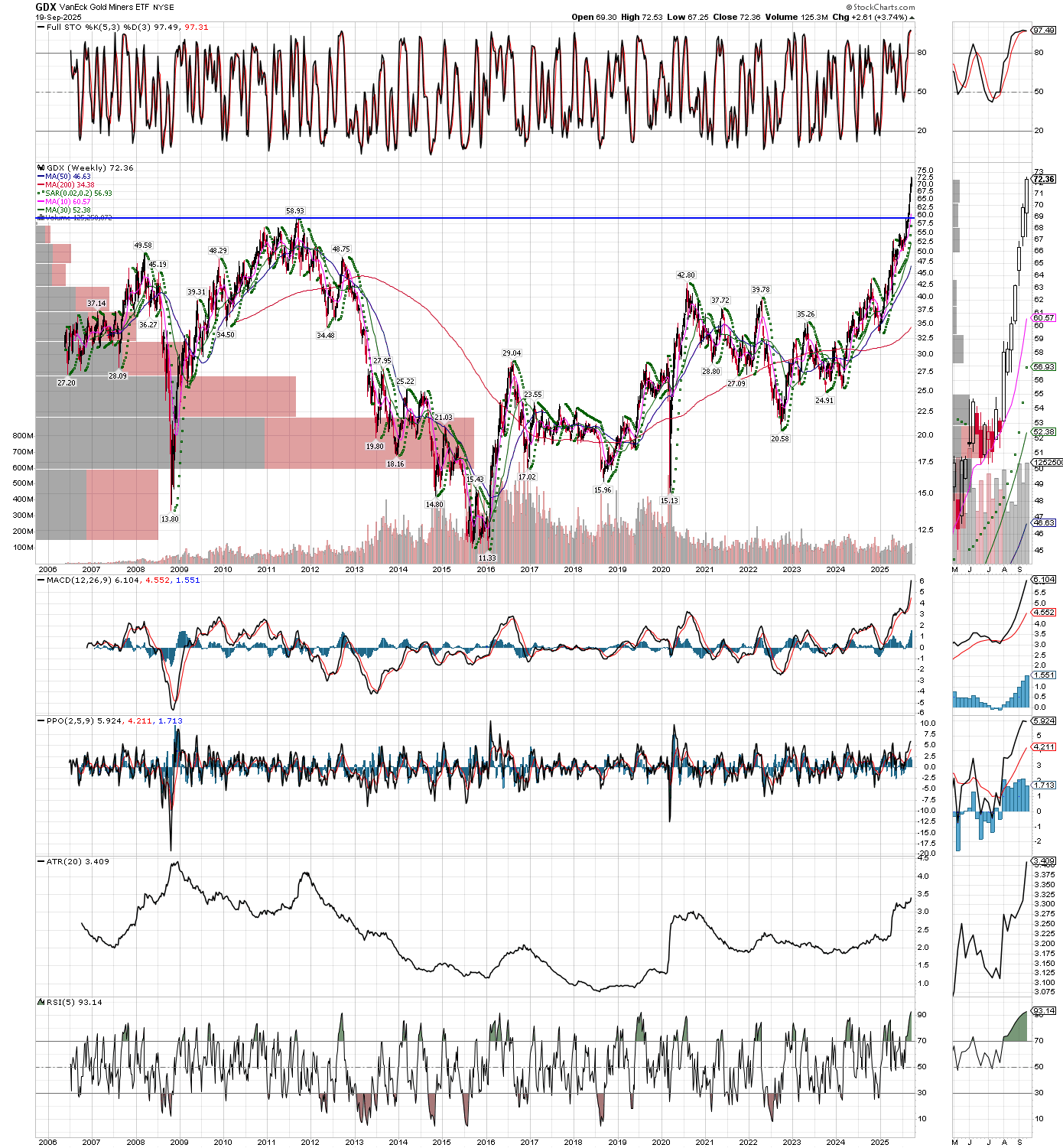

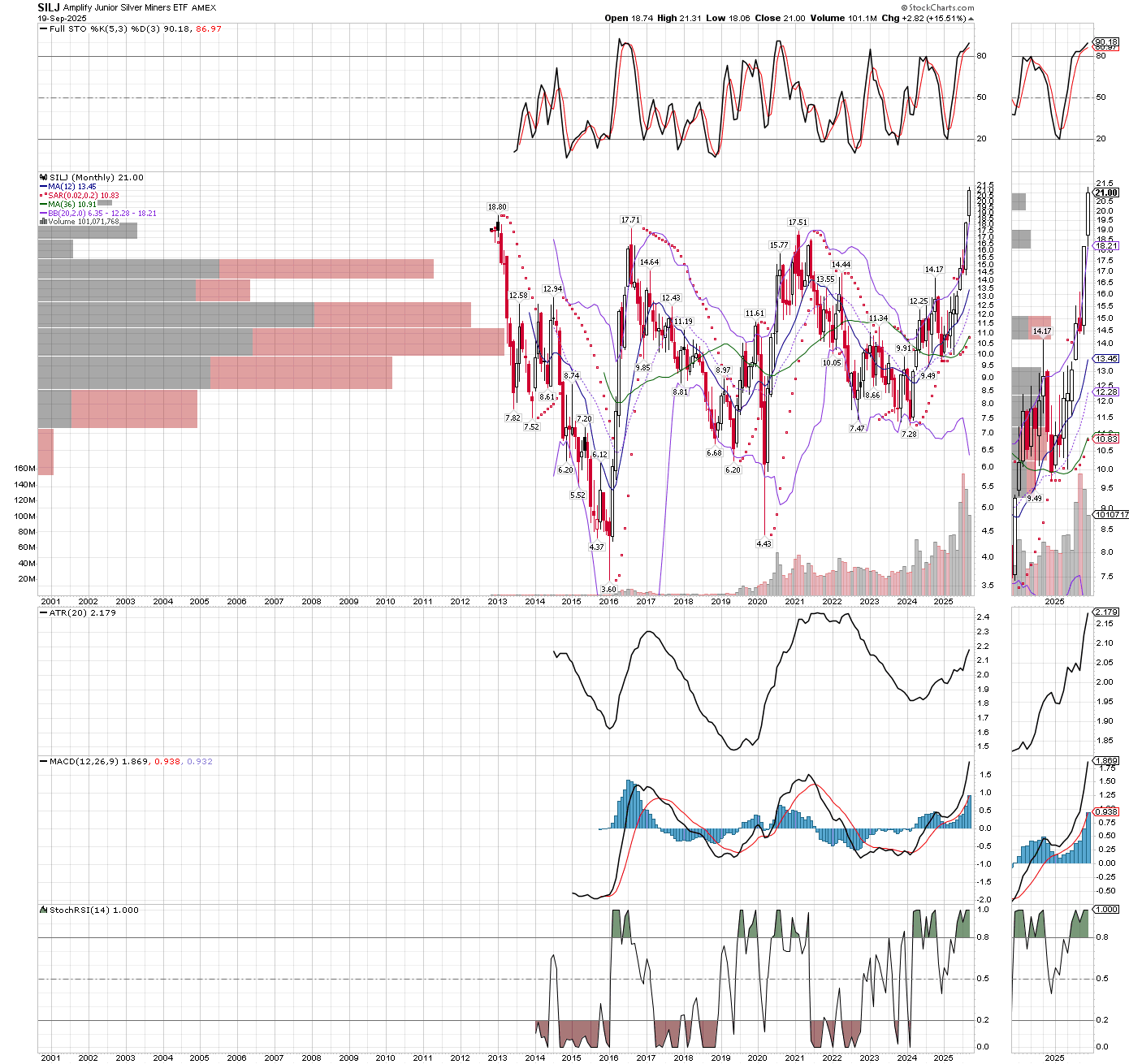

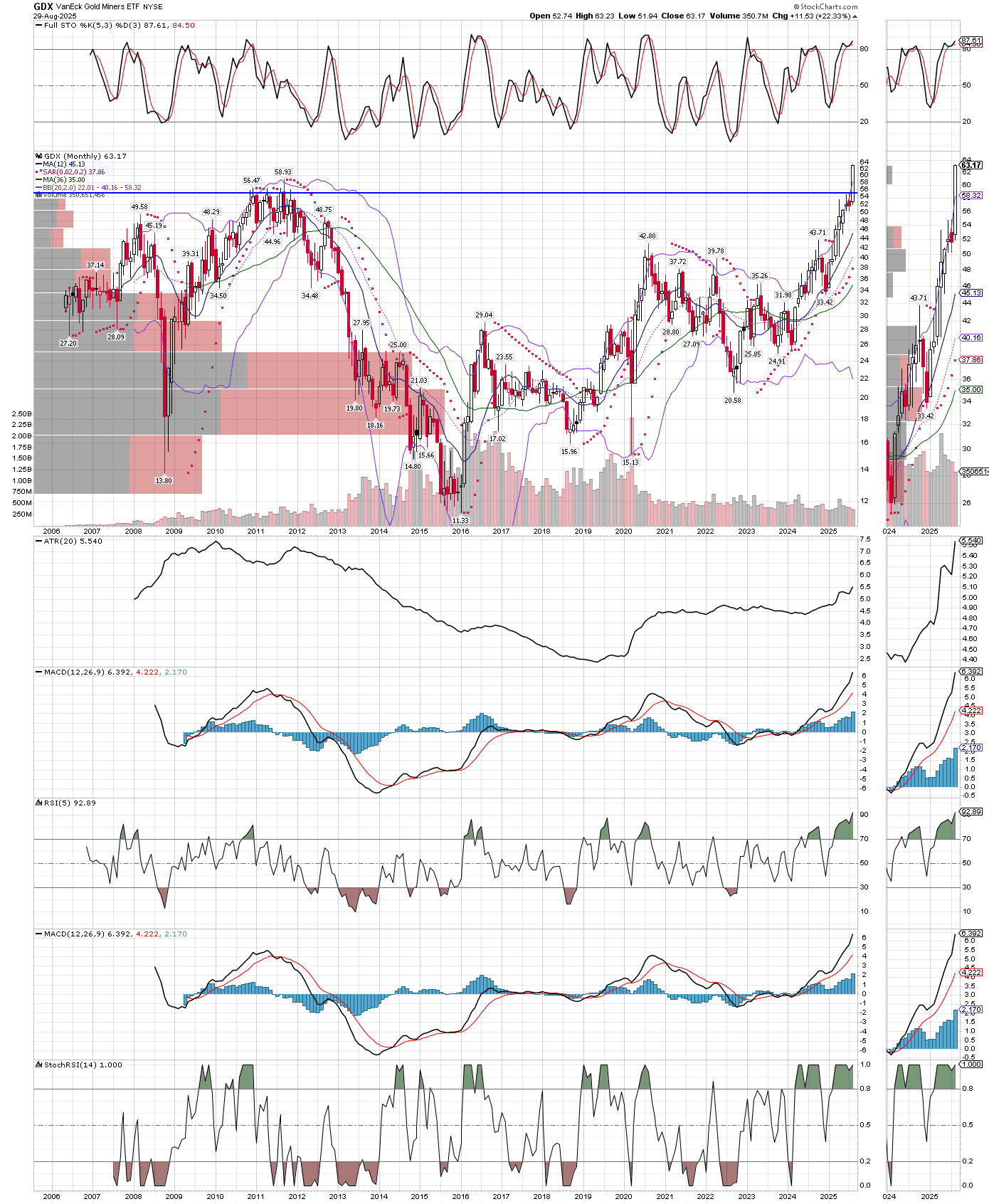

Readers know I am looking to re-deploy funds and profits taken last week. While the metals and miners have already pulled back in price to levels I consider attractive, I am waiting for more time to pass, as corrections are usually functions of both price and time. With price objectives met, I will wait for some time to pass, with the plan that if prices come back down to this area after 6-10 weeks (assuming they bounce soon, then drop again), or if prices just go sideways overall for a few weeks while technicals reset, then I will be ready to buy heavily again.

Also, the extreme volatility must be respected and accounted for, with smaller position sizes in order to contain risk. This forces smaller position sizes, so that when things calm down, one is not invested heavily enough for the next move higher. Much better to wait for some calm, let prices find an area where there are similar numbers of buyers and sellers, so that emotions calm down and. make it conducive to larger bet sizes. After all, position sizing is everything, and there is no need to step in front of a moving train. If I have to pay slightly higher prices but also have some time that has passed and reset the technicals, so be it, then I can place larger bets for a potentially more extended move higher again.

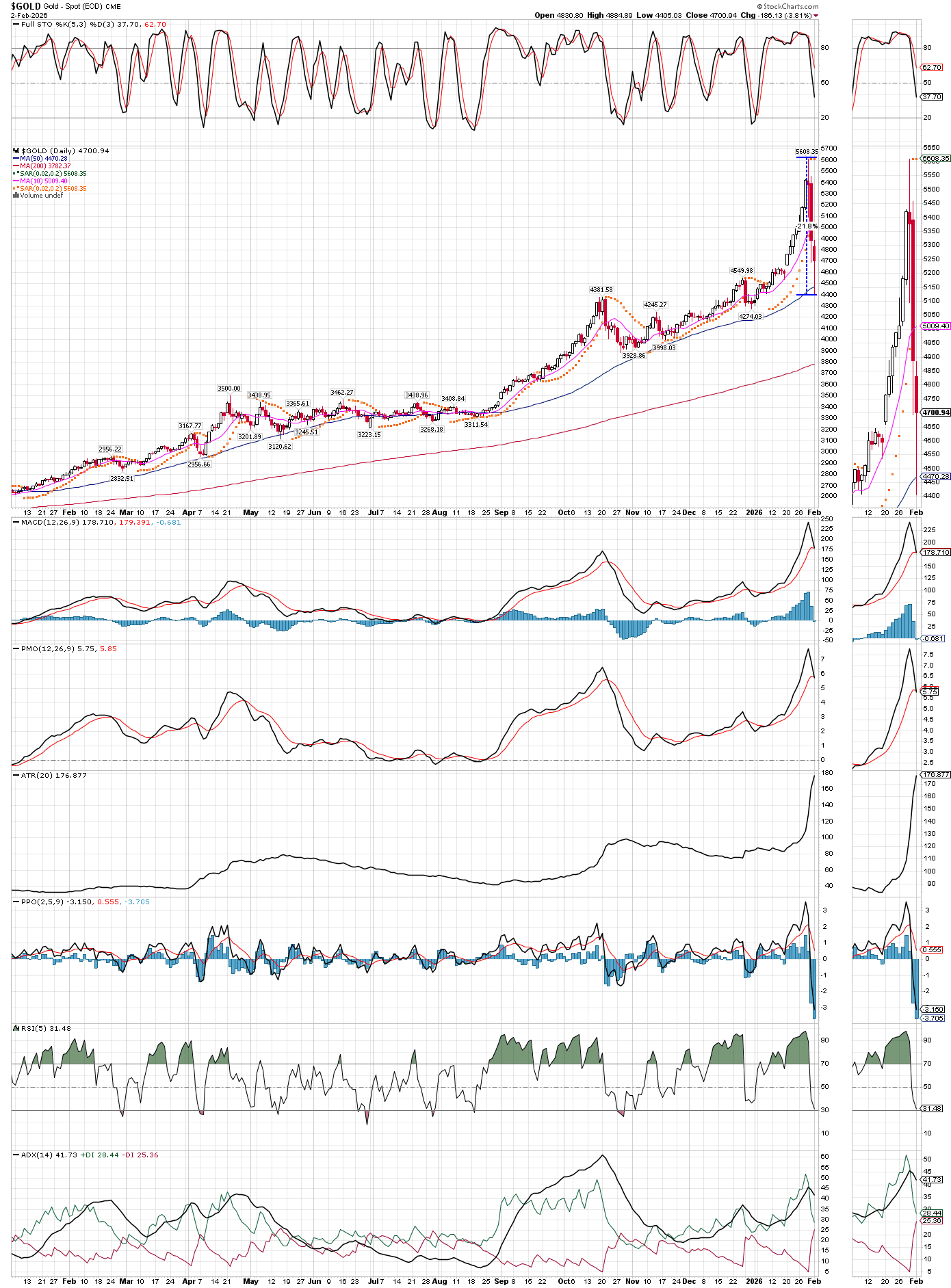

Gold has already dropped 21.5% from the high last week to the low yesterday, that should be enough to shake out many bulls, but things are volatile right now and a big move up or down from here would not shock me. So, its time to sit and keep our powder dry for the next setup. It could even come in energy, like coal and oil stocks, but my hunch is it will still be in the precious metals, there is very little chance that the bull is over in precious metals and miners.