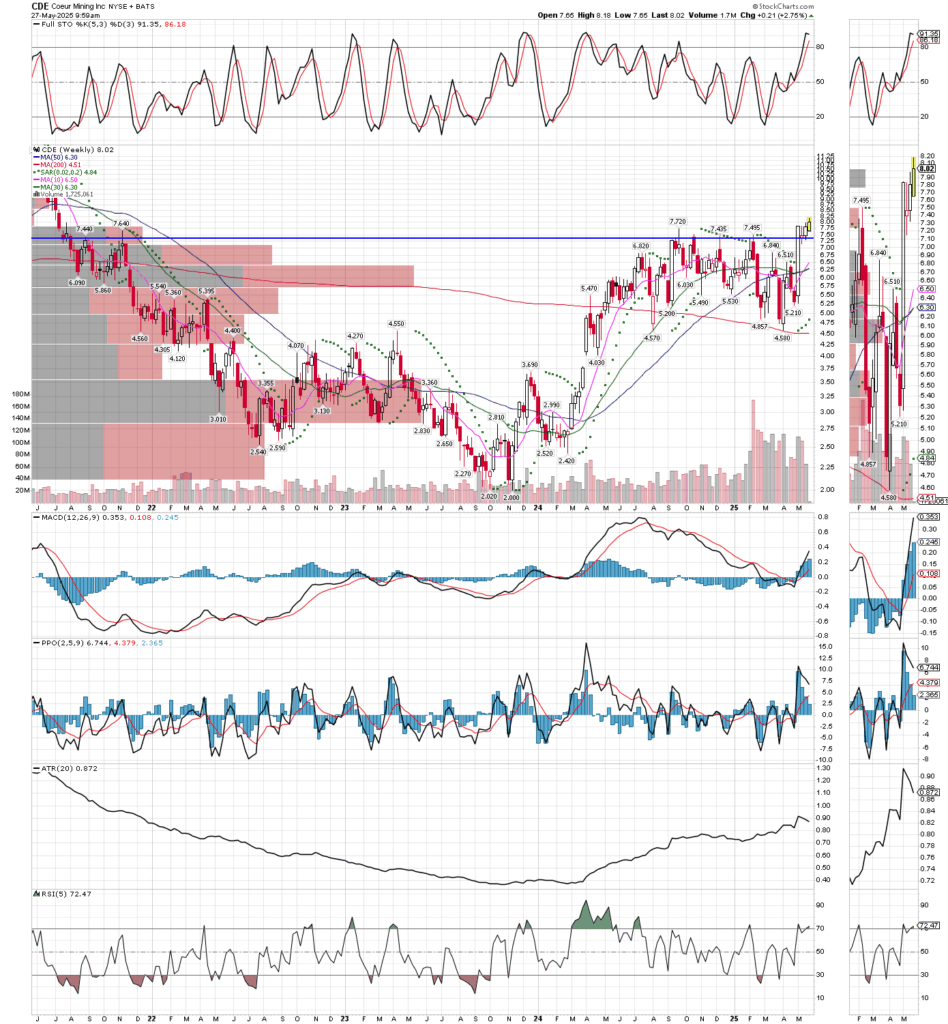

Clear Skies Ahead For Our Largest Holding CDE

May 27, 2025

Just what we want to see, all resistance getting out on the weekly chart, with the MACD sporting a wide-open “mouth” ready for more. The stochastics are getting overbought, but they have not crossed lower yet, and it strong bull moves they often get embedded in overbought territory. We can’t know if this is one of those times or not, but the breakout is signficant no matter what, and next resistance doesn’t show up until the $11.50-$12 area, after that the $16 area might provide a little resistance, however both levels won’t cap CDE for long, then its off to the all-time highs up near $50. Only small pockets of resistance here and there along the way, like the $32-$37 level, but by then we will already have a 10-bagger (10x our investment) on our hands. CDE is our largest holding, and they just announced a $75 million share buyback, and Chariman Krebs said “after years of heavy investment, Coeur is now in position to return capital to shareholders”, just what we want to hear at this point in the cycle. The company get 70% of revenues from gold, 30% from silver at the moment, and in another year or so, it will be 65% gold and 35% from silver, maybe more after the SILV acquisition.

And for a bigger picture, just to see how much potential CDE still has in this bull market, take a look at it’s monthly bar chart (log scale). Note the stochastics have just crossed higher, while the MACD has just opened wide again. This stock can really run, when it decides it’s time. It’s still not to late to capture some huge gains in miners like CDE, but early buys are low prices arer what compounding and exponential gains are made of, so make up your mind soon!